Products

Fast, Reliable, Everywhere

Solutions

Efficient, Innovative EV Charging Solutions.

News

We are committed to the innovation and application of EV charging.

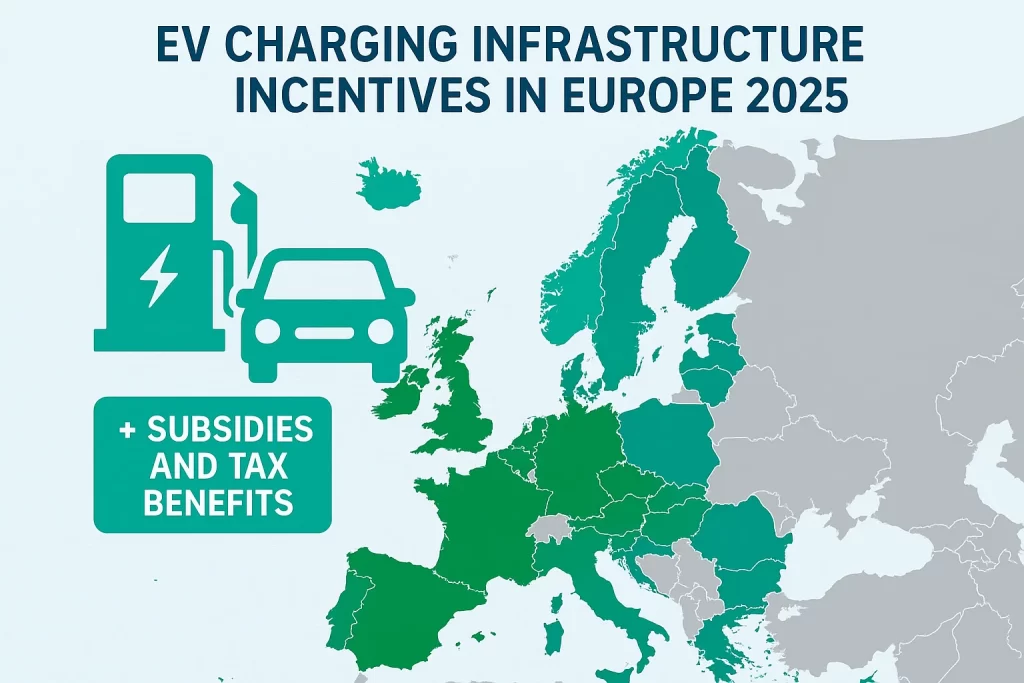

By 2025, Europe’s rapid transition toward electric vehicles (EVs) is reshaping the transportation landscape. A key component of this transition involves building comprehensive charging infrastructure. European governments and the EU are providing substantial incentives and financial support to accelerate the deployment of charging networks, particularly focusing on fast and ultra-fast charging capabilities. This article provides a detailed overview of these incentives and the expected market dynamics.

At the European Union level, the Alternative Fuels Infrastructure Regulation (AFIR) came into force in April 2024, significantly impacting infrastructure development. The regulation mandates at least one 150 kW charging point every 60 kilometers along the core TEN-T road network by 2025. By 2027, this minimum rises to 400 kW stations, aiming for comprehensive coverage by 2030.

Complementing AFIR, the EU’s Alternative Fuels Infrastructure Facility (AFIF) has committed approximately €422 million in funding for 39 cross-border infrastructure projects, driving the rollout of ultra-fast chargers. Furthermore, financing institutions like the European Investment Bank (EIB) and private infrastructure funds such as Marguerite are channeling substantial investment into EV infrastructure, mobilizing private capital to expand the charging network throughout the continent.

Germany remains a frontrunner in EV infrastructure development. The government’s flagship initiative, "Deutschlandnetz," has allocated €2 billion specifically for installing fast chargers nationwide. By the end of 2023 alone, funding reached €630 million, supporting rapid station installations along highways and key urban areas, aiming for more than one million charging points by 2030.

Starting July 2025, Germany will also introduce new tax incentives specifically aimed at boosting EV infrastructure investment. These measures include accelerated depreciation for corporate investments in charging equipment, significantly reducing the initial financial burden for businesses.

France has outlined a clear path under its "France 2030" program, aiming to establish at least 50,000 fast chargers. This ambitious strategy involves public-private partnerships (PPP) and substantial regional government support for businesses installing chargers. Generous subsidies for smart charging solutions and residential charging points further boost this initiative.

Sweden continues to lead in innovative EV infrastructure solutions, notably through the implementation of dynamic charging ("electric roads"), allowing vehicles to charge while in motion. By 2025, this groundbreaking technology will be further advanced, setting a standard for dynamic charging across Europe.

Countries like Spain, Italy, the Netherlands, and Finland have expanded incentives covering hardware purchase, installation, and operating costs for commercial EV charging stations. This support has significantly reduced upfront investment costs, encouraging businesses and private investors to accelerate their charging infrastructure deployments.

In the United Kingdom, the government has implemented multiple initiatives, including land-use support, streamlined approval processes, and even VAT exemptions on public EV charging, saving consumers approximately £200 annually. Such incentives increase the financial viability of deploying fast chargers and are expected to further stimulate private sector investment.

Ireland is rolling out a comprehensive network of roadside ultra-fast chargers, partly funded by the Zero Emissions Vehicles Ireland initiative. Up to 60% of the costs associated with establishing new fast-charging points can be subsidized under this scheme, greatly benefiting the expansion of reliable and widely accessible public EV infrastructure.

The private sector is playing a significant role in Europe’s EV infrastructure expansion. Notably, Charge France has pledged an impressive €3 billion investment by 2028 to create a network of over 40,000 fast charging points. Major Charge Point Operators (CPOs) have also raised hundreds of millions of euros via green bonds specifically to finance their European expansion projects.

In the UK, the insurance sector is increasingly involved, advocating for green infrastructure investment vehicles designed to attract private institutional capital. Industry estimates suggest this could unlock around £2 billion in additional investment into EV charging networks across Britain.

By mid-2025, Europe will have surpassed one million public charging points, driven largely by these coordinated incentive programs and growing market demand. Professional studies estimate that Europe will require approximately 8.8 million charging points by 2030, indicating an urgent need for continued rapid expansion—an average addition of around 5,000 new chargers per week.

A notable trend is the steadily increasing average power capacity of fast-charging stations. European networks are progressively shifting toward higher-power units (350 kW to 400 kW), enabling faster charging and meeting drivers’ growing expectations for minimal downtime during trips.

Fast chargers typically require substantial initial investments. A single fast-charging unit (e.g., 150–350 kW) typically costs around €50,000 per station, excluding installation costs, which can account for an additional 30–50% of the equipment price. However, incentive programs across Europe often subsidize between 40–80% of these total costs, and in some cases cover more than 100%, significantly lowering entry barriers for investors.

Notably, Germany and France lead in providing comprehensive financial support, covering equipment and installation expenses, thus drastically enhancing commercial feasibility and reducing investment risks.

EU policy requires subsidized projects to adopt Open Charge Point Protocol (OCPP 2.0.1), facilitating advanced features such as intelligent load balancing, Vehicle-to-Grid (V2G), and renewable energy integration. These features not only reduce strain on electrical grids but also improve the economic performance of charging stations by optimizing energy usage and lowering operational costs.

In 2025, Europe's comprehensive suite of incentives and regulations is set to significantly accelerate EV charging infrastructure deployment. High levels of financial support, strategic regulatory frameworks, innovative technology integration, and active private-sector engagement are creating unprecedented opportunities.

For businesses, local governments, and investors, the strategic implications are clear:

Leverage substantial EU and national government subsidies and green infrastructure funds.

Implement advanced smart charging solutions to enhance efficiency and long-term competitiveness.

Monitor evolving technologies, including dynamic charging and V2G systems, to capitalize on future market shifts.

By carefully navigating and strategically leveraging these incentives and trends, stakeholders can effectively position themselves to not only contribute to Europe’s green mobility transition but also achieve substantial economic and environmental gains.