Products

Fast, Reliable, Everywhere

Solutions

Efficient, Innovative EV Charging Solutions.

News

We are committed to the innovation and application of EV charging.

The global shift toward electric vehicles (EVs) is gaining unstoppable momentum. Over 10 million EVs were sold last year alone, and projections suggest that by 2030, more than 240 million electric cars, vans, trucks, and buses will be navigating global roads.

This surge in EV adoption presents both a challenge and an opportunity for traditional fuel retailers. A study by Boston Consulting Group indicates that without major business model adjustments, up to 25% of gas stations could shut down by 2035. However, these locations are uniquely positioned to evolve into modern EV charging hubs—especially with the expansion of high-speed DC charging infrastructure.

Gas stations have historically adapted to changing consumer needs and market conditions. Originally built to refuel cars, stations gradually added convenience services like food, groceries, and car washes. By the 1960s, the modern service station had taken shape.

Today, fuel retail is a major contributor to the global economy. In the U.S., convenience stores account for 80% of all fuel sales. But with rising environmental concerns, tight fuel margins, and the growth of electric mobility, traditional revenue models are under pressure.

Rather than seeing EVs as a threat, smart gas station operators are seizing the chance to reinvent themselves for the electric era.

The transition to electric mobility is being powered by three main sectors:

Individual consumers are playing a significant role in the EV revolution. The International Energy Agency (IEA) projects that EVs could make up two-thirds of new vehicle sales in developed countries by 2040. This number could grow even higher with favorable policies and incentives.

A key factor behind this growth is the widespread deployment of fast-charging technology, which significantly reduces charging time and eases “range anxiety.” As these stations become more common along highways and in urban areas, more drivers are expected to make the switch to electric.

Corporations and public institutions are rapidly converting their fleets to electric. Influenced by climate commitments, social pressure, and economic savings, brands like Amazon, Uber, IKEA, and UPS are investing in electric delivery vans and cars.

Fleet electrification not only supports corporate sustainability goals but also helps grow the secondary EV market and encourages broader infrastructure investment.

Original Equipment Manufacturers (OEMs) are intensifying their EV strategies. By 2025, nearly 400 new electric vehicle models are expected to enter the global market. Price parity between EVs and internal combustion engine vehicles is also within reach.

Automakers are no longer just vehicle producers—they’re becoming infrastructure providers. Tesla, for example, has built an extensive global charging network. Rivian and Ford are following suit, expanding their own fast-charging capabilities. Fuel retailers must now compete not only with each other but with OEMs creating vertically integrated ecosystems.

Policymakers are accelerating the development of EV infrastructure, particularly in key markets like the United States, European Union, and the United Kingdom:

USA: The Bipartisan Infrastructure Law allocates $7.5 billion for national EV charging infrastructure through the NEVI program.

EU: Targets include 3 million public charging points by 2030 as part of the European Green Deal.

UK: A £1.6 billion investment is aimed at installing 300,000 public EV chargers by 2030.

With strong regulatory backing and financial support, the EV charging sector is expected to grow from a niche to a $20 billion market by 2030, as estimated by McKinsey & Company.

Gas stations are perfectly positioned for the next phase of the mobility transition. Their strategic roadside locations, large footprints, and existing customer base make them ideal candidates for EV infrastructure upgrades.

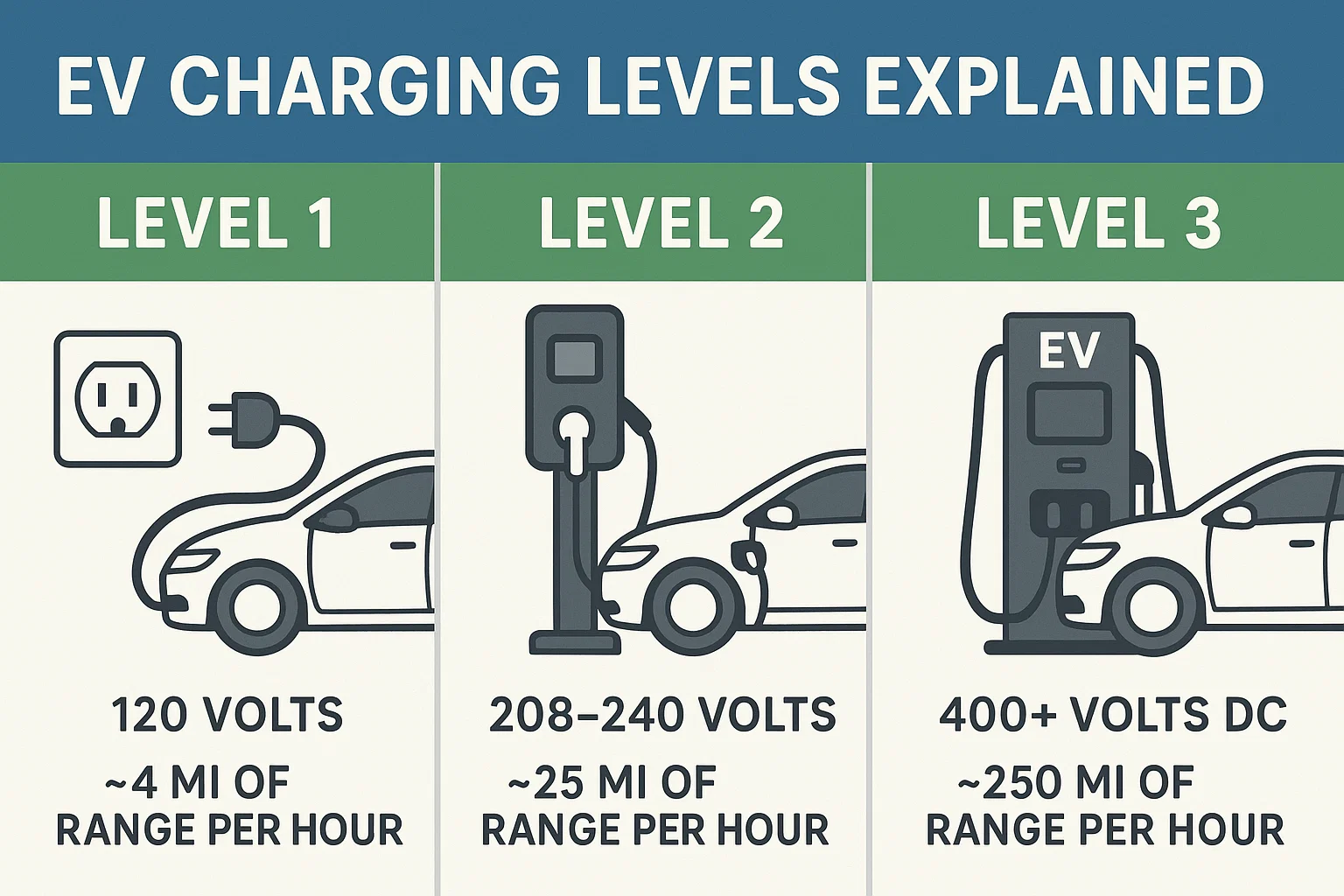

DC fast chargers—also known as Level 3 chargers—can replenish an EV battery in 15–30 minutes, compared to several hours with AC chargers. These high-power stations align with the convenience-oriented expectations of drivers and offer a competitive edge.

A recent Ipsos survey shows that 29% of EV drivers already charge at gas stations, while another 21% are interested in doing so. Offering fast charging can attract this growing segment of high-value, environmentally conscious customers.

By integrating EV charging, gas stations unlock multiple advantages:

Attract new customers: EV drivers often spend more time on-site, increasing the potential for additional purchases.

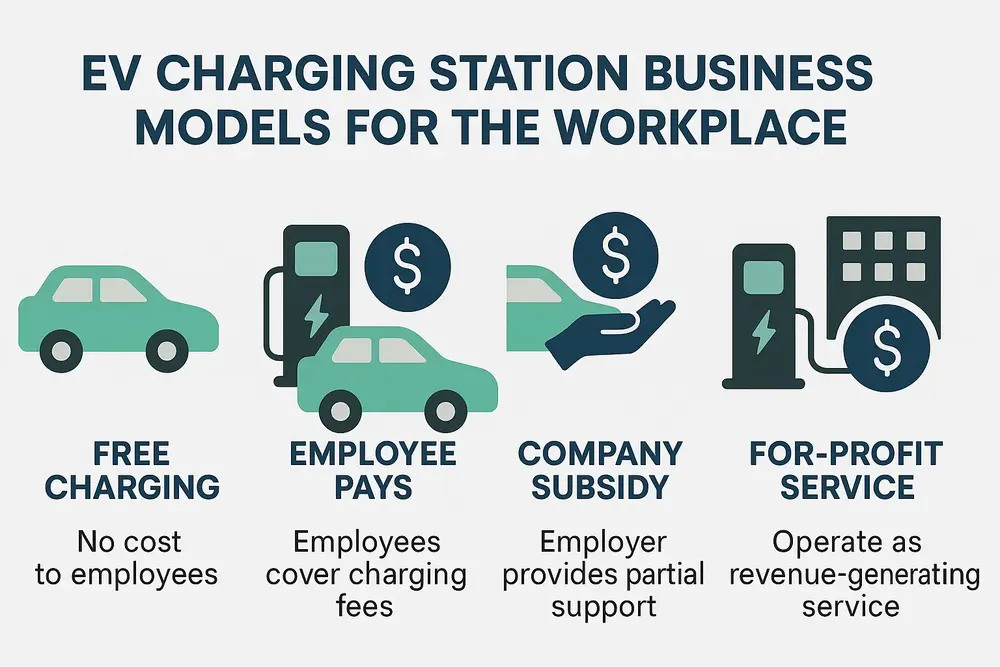

Generate new revenue streams: Charging fees and upselling in-store items can offset declining fuel margins.

Enhance sustainability branding: Offering clean energy alternatives improves environmental performance and brand perception.

Protect market share: Prevent customer loss to OEM-owned charging networks or independent CPOs (Charge Point Operators).

As EV adoption rises, competition for charging access will intensify. Forward-thinking retailers that act now can secure their position as essential hubs in the clean transportation ecosystem.

The rise of electric vehicles is reshaping the fuel retail landscape. Rather than resisting this shift, innovative fuel retailers are embracing it—transforming their stations into future-ready mobility centers.

By investing in DC fast charging stations today, gas stations can align with consumer trends, take advantage of government incentives, and establish themselves as leaders in the green mobility revolution.